Content

Debit NoteA debit note is a confirmation document sent by a buyer for returning purchased goods or services to a seller. Cindy works for Fluffy Stuffs Inc., a toy company specializing in the manufacture of stuffed animals. The company has recently sold a large shipment of stuffed animals to Toys N’ More. Cindy billed the company for the stuffed animals sold, but worked off of an old pricing sheet to create the invoice. This is normally not a large problem except that the market price for stuffing has increased dramatically. Therefore, Cindy has created a debit memo to inform Toys N’ More of the increase in price due to current market conditions. A debit memo is used to denote an adjustment to a customer’s account that reduces their balance.

- For each service data object, the result includes the QName, internal name, and Boolean values indicating whether create, update, merge, and delete operations can be performed on the object.

- The bank’s use of the term debit memo is logical because the company’s bank account is a liability in the bank’s general ledger.

- In formal parlance, it is notifying a customer that the debit memorandum will be increasing their accounts payable.

- Bank transactions are related to any fees or service charges, incremental billing is when a client was undercharged by accident, and internal offsets are for offsetting any positive balances.

- They are categorized as current assets on the balance sheet as the payments expected within a year.

(You can read up on ticketing air through GDS here!) Their goal is to make the debit memo process more efficient . Not only can you eSign a contract, but you can also send a link to the document to your teammates and vendors with the help of signNow for Android. Use the full-featured solution to generate an eSignature and reuse it in the future for document verification. Bpi what is credit memo bpi in bpi fast and conveniently. May I get the debit memo with out registering your account? SignNow gives the debit memo for almost any consumer who gets a unique ask from signNow, even when they never have got a signNow account.

Incremental Billing

ARC—a travel agency accreditation organization that provides billing settlement—is the intermediary between the carriers and US-based agencies, so they issue the debit memos to U.S.-based agencies. When Debit Memo Definition it comes to travel agencies outside the US, IATA—an international accreditation organization that also provides billing settlement—sends debit memos to agencies on behalf of the airline carriers.

A debit note is information regarding a past transaction that remains unpaid, whereas an invoice records a sales transaction that has been completed. Debit notes are based on accounts receivable accounts, while invoices are used for sales for which payment has already been made. Transactions that give rise to debit memos when it comes to retail banking are bank service fee, checkbook printing, charges due to insufficient funds of a check or checks issued. To apply for this discount, the buyer will issue the seller a debit memorandum. The debit memo notifies the seller than the buyer has received nonconforming goods, wants to keep them, and is debiting its payable account for the discounted price. When the buyer debits its accounts payable, it is reducing the amount of money that it owes the seller in the buyer’s accounting system.

Examples of Debit Memo?

Many larger companies adopt the procedure of raising a debit note for any errors on invoices. For instance, if a customer purchased and paid for $2,000 worth https://business-accounting.net/ of lumber in April, then the price of the lumber climbed to $2,100 when it was delivered in June, a debit memo may be given for the $100 difference in price.

Debit Memos.In connection with the representations and warranties in Section 5.19, the Company and the Purchaser shall, after the Closing Time, act in good faith with respect to the debit memos and the collection thereof. A list of service data objects defined on this service. For each service data object, the result includes the QName, internal name, and Boolean values indicating whether create, update, merge, and delete operations can be performed on the object. Specify how credit memos are automatically applied during payment runs. Preview credit memos in billing previews, bill run previews, subscription previews, or amendment previews through the REST API.

Sign Debit Memo

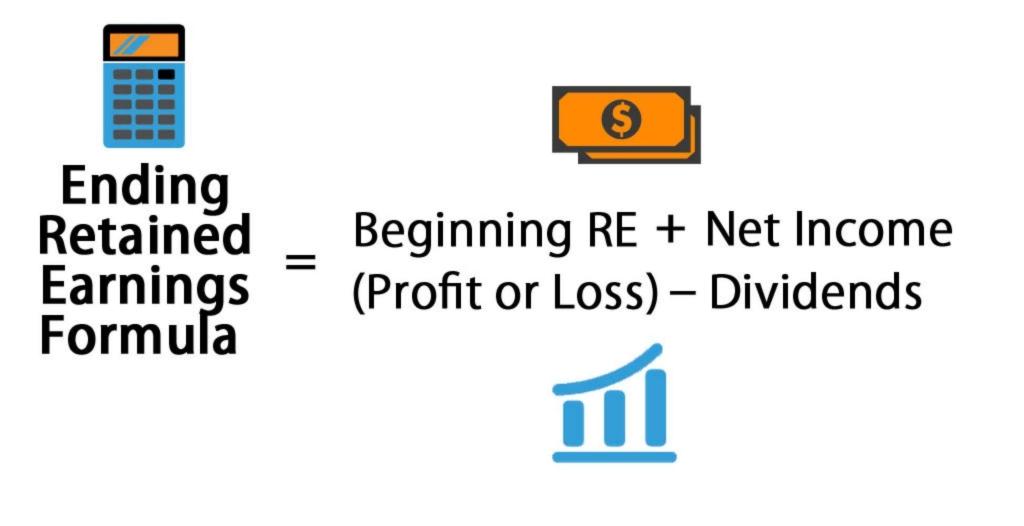

The reasons a debit memorandum would be issued relate to bank fees, undercharged invoices, or rectifying accidental positive balances in an account. The opposite of a debit memorandum is a credit memorandum. In business-to-business transactions, a debit memo is issued as an adjustment procedure following an inadvertent under-billing of goods or services provided to a customer. In formal parlance, it is notifying a customer that the debit memorandum will be increasing their accounts payable. For instance, if ABC Co. fills an order for XYZ Inc. and invoices the customer in an amount that is short of the agreed amount, ABC Co. will issue a debit memo to XYZ Inc. to indicate and explain the balance due. In retail banking, a debit memorandum is given to an account holder indicating that an account balance has been decreased as a result of a reason other than a cash withdrawal or cashed check. Debit memos can arise as a result of bank service charges or bounced check fees.

How do I get a debit memo?

- Customer's name, address, and communication details.

- Your Company's name, address, and communication details.

- Tax Details of your company as well as the other company.

- Item Description, Quantity, Rate per unit, Total Taxable value.

- Invoice Number and Invoice date.

- Details of the transactions.

The purpose of these memos is to raise an ad hoc charge or credit not related to a specific invoice. The memo items refer to one-time product rate plan charges. These charges do not have to be part of any subscription. Standalone credit memos can be applied to any invoice or debit memo with a positive balance. The purpose of debit memos for business to business transactions is to rectify a billing error issued by one party to the other. Keep in mind, a debit memorandum is a debit to the sender’s accounts payable and a credit to the receiver’s accounts receivable.